The pandemic that has so far claimed over 69,000 lives and devastated economies across the globe has brought India’s commercial passenger operations in an already fragile aviation industry to a halt.

As the COVID-19 pandemic unfolds in multiple hotspots across the globe, the aviation industry is one of the worst-hit. HealthLEADS examined civil aviation data from India to decode the fall in air traffic in March 2020 and its implications for the bleeding industry.

India’s first case of COVID-19 was detected on January 30, 2020, when the rest of the world had already seen more than 7800 cases and 170 deaths. Travel restrictions for passengers coming in from heavily-affected countries came into effect slowly, with the initial checks starting on February 5.

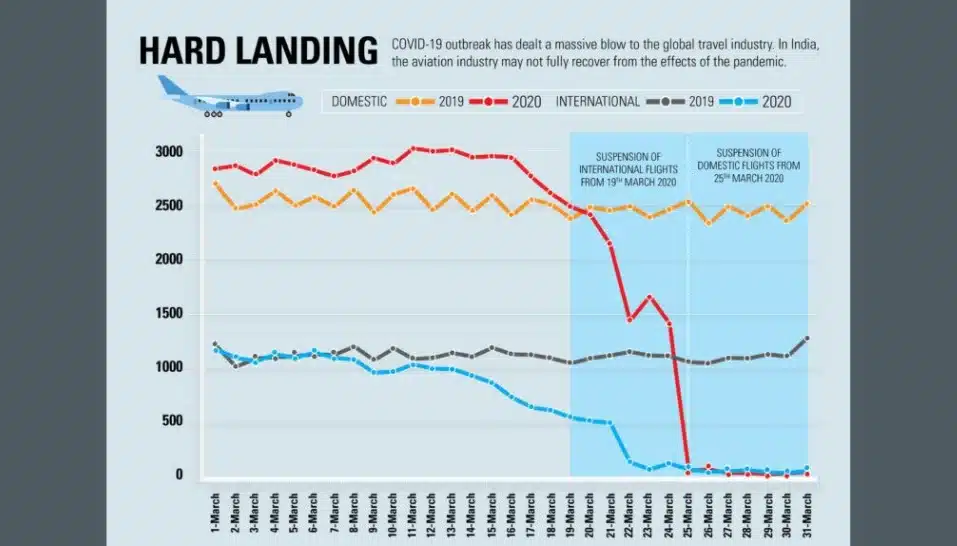

Stringent travel measures and restrictions started in early March, when visas to nationals of Italy, Iran, South Korea, and Japan were suspended, through a circular announcement by the country’s Bureau of Immigration (BoI). On March 11, the BoI extended the visa suspension to all foreign nationals intending to visit India. Within a week, advisories issued by the Directorate General of Civil Aviation (DGCA) led to a complete ban on all international flights to and from India. A nation-wide total lockdown for 21 days came into effect from March 25.

The Ministry of Civil Aviation ordered the suspension of all domestic commercial passenger flights within India until March 31. The suspensions – domestic and international – were subsequently extended till April 14.

HealthLEADS analysed the civil aviation data to decode the fall in air traffic in March 2020, as compared to the same time last year.

The suspension orders exempt all commercial cargo flights and flights operated on behalf of the state or central governments. Consequently, there have been repatriation as well as freight flights operating in and out of Indian airports.

SpiceJet has been operating several domestic cargo flights. IndiGo, through a press release dated March 25, offered its planes, equipment, and crew in support to the Indian government to ferry vital supplies and medicines within India.

Shares of IndiGo and SpiceJet plummeted upon the news of domestic suspensions. IndiGo traded at ₹856.95 on March 24, seeing a drop of over 35 percent from its January 1 value. SpiceJet, on the other hand, fell to an all-time low of ₹32.35, a drop of over 72 percent.

Deirdre Fulton, a partner at MIDAS Aviation, a UK-based team of aviation specialists, remarks that the drop in commercial air capacity has never been this deep, or this sustained, or this global. Economic reports published by the International Air Transport Association (IATA) estimate that the global aviation industry could face a passenger revenue loss of $252 billion in 2020, wiping out 44 percent of their total earnings.